We Provide

360 DEGREE

SOLUTION

FOR ALL LIFE

STAGES

Why choose us?

Families &

Institutions Impacted

Industry Expertise

Codes Served

Served Worldwide

We have already helped thousands of people successfully join

the investment economy and take control of their lives, careers and finances….

and now it’s your turn.

Trusted by

Investors like you

“The team at AAS are the most reliable people in the city. They always act in my best interests.”

Mr. Jiban Saha

Councillor and Member

Kolkata Municipal Corporation

“On a personal level, investing with AAS has been my wisest financial decision so far.”

Mrs. Soumyasree Basu

Content Creator and Educator,

Kolkata, India

“Personalised support from AAS made investing effortless. My trust in AAS helps me sleep better at night.”

Mr. Satrajit Chatterjee

Computer Engineer,

Solution Architect, IBM.

“AAS have guided my portfolio’s growth since 2015. I don’t think there’s a better approach to investing than what AAS does.”

Mr. Sabyasachi C. Thakur

Chief Information Officer,

Parksons Packaging Ltd.

“AAS has helped me navigate complex financial decisions with ease. I appreciate what I’ve learned from AAS.”

Mr. Partha Pratim Mitra

Former Business Manager,

Philips Healthcare

The Proven Process that

powers your investments

We analyse your

current financial

condition and create

your risk profile

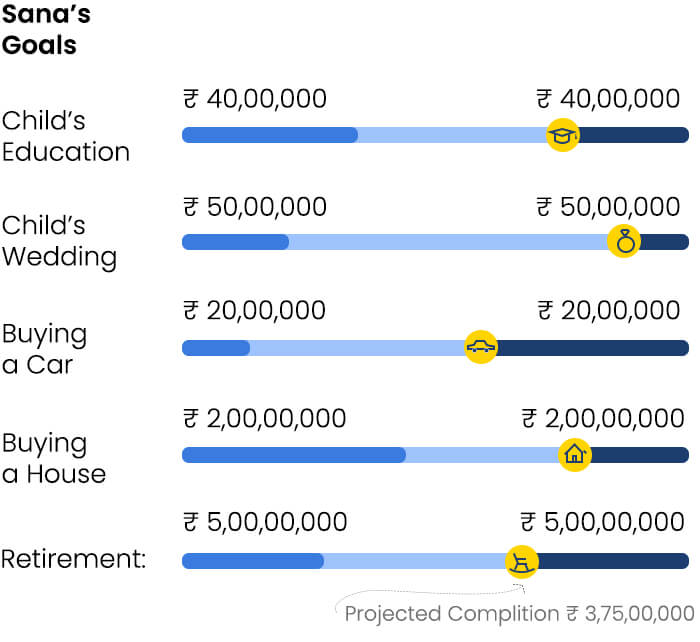

We plan your

investment goals

according to your

financial condition

and risk appetite.

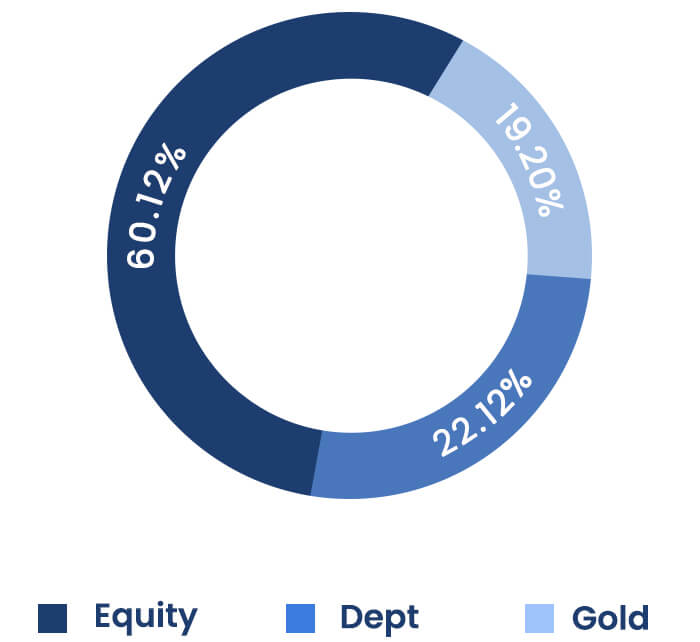

We recommend you for

asset allocation &

mutual fund scheme selection.

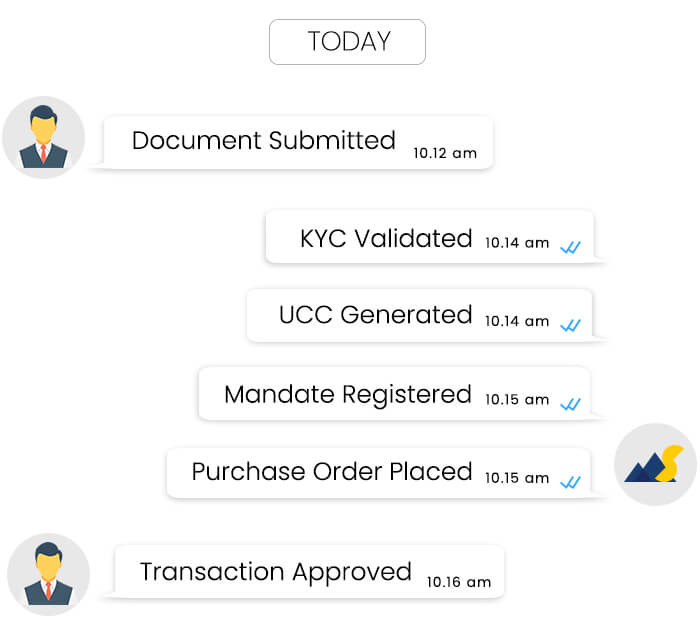

We help you to execute

your investment strategy &

achieve your financial aspirations.

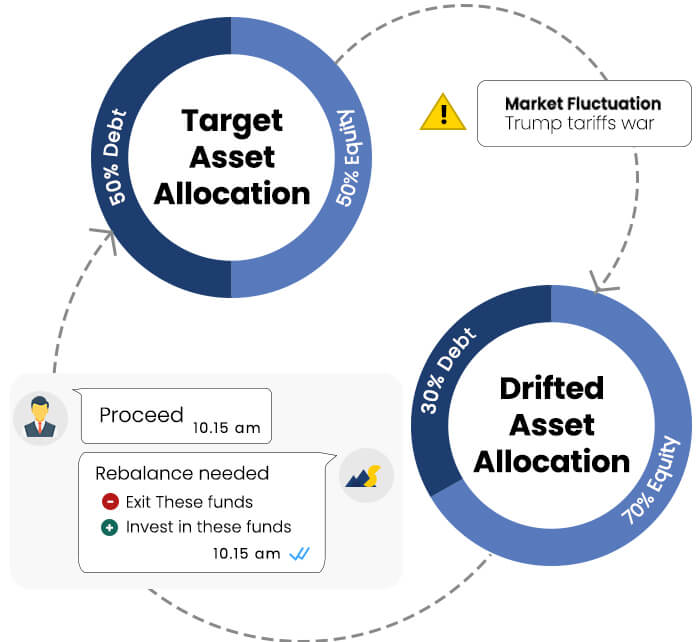

We support you

along the way by tracking

and rebalancing your mutual fund portfolio.

Who we serve?

High Income

Individual (HNI)

We help individuals build disciplined, goal-oriented portfolios. Our focus is on steady, long-term growth – balancing potential returns with your comfort for risk..

High Income

Individual (HNI)

Ultra HNI

Exclusive financial solutions for wealth preservation, legacy planning, and access to high-value investment opportunities.

Ultra HNI

Corporate

Optimize surplus funds, manage treasury, and enhance employee benefits with strategic investment solutions.

Corporate

Retail Client

We help individuals build disciplined, goal-oriented portfolios. Our focus is on steady, long-term growth—balancing potential returns with your comfort for risk.

Retail Client

Trusts

Secure and grow assets with tailored investment strategies, ensuring long-term stability and compliance.

Trusts

HUF’s

Build and preserve family wealth with expert guidance on investments, risk management, and succession planning.

HUF’s

Does this sound similar?

If you can relate, you’re not alone!

Book a call to

achieve your

financial goals

What you get on a call?

Analysis of your current financial condition

Risk Profiling + Suitability Assessment

Expert recommendation

Login access built for ease

Analyse

Gain deep insights into Scheme Performance, Compare Options, and Make Informed Investment Steps for desired results.

Transact

Execute, manage, and track transactions from BSE, NSE & MFU collectively—all in one place.

Review

Evaluate your Entire Portfolio, Track Progress, and Adjust Strategies for enhanced Wealth Management Outcomes.

Still got questions?

We’re here to help you.

Why should I choose AAS Investment over others?

We have over 15 years of investing experience and are trusted by 1000+ families and institutions across 10+ countries. Your wealth will managed by a team of experts who follow a proven process and investment philosophy. As a result, we have constantly been beating the benchmark over the years.

Is my money safe with AAS Investment?

All investments are made in your name (you hold the investment) and whenever any investment changes are needed, we take your consent before we implement them. As an AMFI-registered distributor (ARN-175318), we follow SEBI & AMFI regulations, ensuring investor protection.

What is the starting investment?

The minimum investment depends on the mutual fund scheme. For SIPs, it starts as low as ₹500 per month, while lump sum investments typically begin at ₹5,000.

Why mutual funds instead of other investment instruments?

Mutual funds offer higher returns (12-15% CAGR in equities), diversification, professional management, and liquidity, outperforming FDs (5-7%) and other fixed-income options.

Your vision builds the Nation,

our vision builds YOU.